As a business owner, you may need funding for various reasons such as expansion, inventory purchases, equipment upgrades, or cash flow management. That’s where business loans come in handy. But how do business loans work, and what should you consider when applying for one? In this article, we’ll cover everything you need to know about business loans, including types of loans, eligibility criteria, application process, and repayment terms.

1. What are Business Loans?

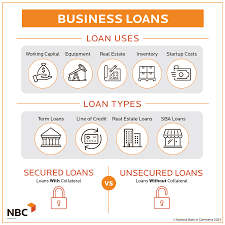

A how do business loans work is a type of financing that provides funds to businesses for various purposes. These loans can be used for working capital, expansion, equipment purchases, inventory management, and more. Business loans are typically provided by banks, credit unions, online lenders, and other financial institutions. The terms and conditions of business loans can vary widely based on the type of loan and the lender.

2. Types of Business Loans

There are several types of business loans available to suit different needs. Some of the most common types of business loans include:

Term Loans

Term loans are a popular type of business loan that provides a lump sum of cash upfront that is repaid over a fixed period of time, usually with interest. These loans can be secured or unsecured, and the repayment term can range from a few months to several years.

SBA Loans

SBA loans are backed by the Small Business Administration and are available to small businesses that meet certain eligibility criteria. These loans are designed to help small businesses grow and can be used for various purposes, including working capital, equipment purchases, and real estate.

Equipment Loans

Equipment loans are designed to help businesses purchase equipment or machinery needed to operate or grow their business. These loans can be secured or unsecured and typically have a shorter repayment term than term loans.

Business Lines of Credit

Business lines of credit are similar to credit cards in that they provide a revolving line of credit that businesses can draw from as needed. These loans can be secured or unsecured and typically have a lower interest rate than credit cards.

Invoice Financing

Invoice financing is a type of loan that provides businesses with immediate access to cash by using outstanding invoices as collateral. This type of financing can be helpful for businesses that have cash flow issues due to slow-paying customers.

Merchant Cash Advances

Merchant cash advances are a type of financing that provides businesses with a lump sum of cash upfront that is repaid through a percentage of future credit card sales. These loans can be helpful for businesses that have a high volume of credit card sales but may not qualify for traditional loans.

3. Eligibility Criteria for Business Loans

The eligibility criteria for business loans can vary widely based on the type of loan and the lender. Some common eligibility criteria include:

- Credit score

- Business revenue and profitability

- Business age

- Collateral

- Industry type

- Business plan